Door Number One

Insight to Understanding

In this series, we’re exploring the power of market regimes in a wealth management context.

Our belief is simple: when investors and advisors can clearly distinguish the different environments the markets cycle through, they can have more realistic expectations, build better portfolios, and protect compounding by increasing the probability the portfolio is held through the inevitable difficult periods.

Most portfolio reporting obscures conditional risk. When stress arrives unexpectedly, surprise leads to selling, and selling breaks compounding. A solid understanding of market regimes helps break the cycle.

The Single-State Problem

In our last post, we talked about the “Frankenstein portfolio,” a portfolio built by blending exposures designed for different environments into one permanent allocation. Once we are able to define regimes in a disciplined, forward looking, repeatable way, though, new doors open. This post walks through the first door that takes us from insight to understanding.

Let’s dive in.

The Key: Blended Distributions

I haven’t inspected the books of our local ice-cream shop. But if we did, we’d likely find a stream of monthly revenues that looks fairly normal—something we could summarize with a single distribution and call it “the business.”

What if we separated that revenue stream into seasonal regimes -- summer, fall, winter months -- and measured each one on its own? Suddenly, we’d understand the business more clearly: not just average revenue, but when risk concentrates. These are times when variance expands, and downside becomes more likely.

Financial markets behave the same way. The experience is conditional, rather than single-state. The financial markets are complex; nevertheless, the same way that seasons help us understand the ice-cream parlor business, regimes help us understand investment strategies.

We open Door One with our Regime X-Ray, a diagnostic that seeks to understand strategies and how their performance is conditional across distinct regimes. We don’t ask, “What is this strategy on average?” Instead, we ask: What does this investment look like across environments investors actually live through?

To make this real, let’s look at two all-star investments with long histories: two strategies nobody needs to defend, yet which yield very different holding experiences.

Example 1: Berkshire Hathaway (BRKB)

Let’s be clear: Our Regime Diagnostic is not a test for a strategy to pass or a good / bad judgment. If you’ve owned Berkshire Hathaway for decades, the results speak for themselves, and that is exactly why it’s such a useful case study. Rather than focusing on performance, we seek to understand the path versus the result. The question is, "what behavioral hurdles did an investor have to deal with to capture the elite investment experience?"

What the BRK-B X-Ray Reveals

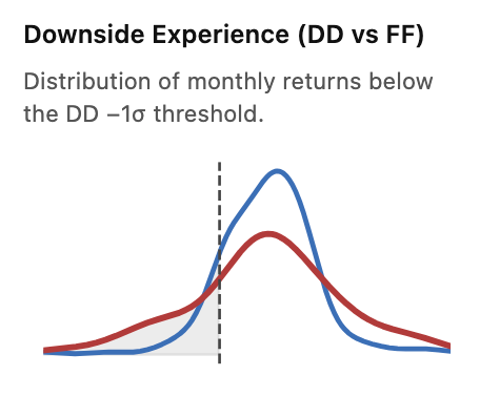

One of the most useful widgets in the diagnostic is the “Downside Experience” lens: it compares stress in supportive Durable Macro – Durable Market (DD) conditions vs fully fragile conditions (FF).

FF produces slightly more downside months than DD (17% vs 16%).

FF produces slightly more downside months than DD (17% vs 16%).

When breached, FF drawdowns are deeper on average (-8.2% vs -6.2%).

Stress differs across regimes, but the downside experience remains broadly consistent.

And this last point matters more than the numbers themselves. For Berkshire Hathaway, consistency reduces surprise. Reducing surprises is one of the most practical ways to protect behavior.

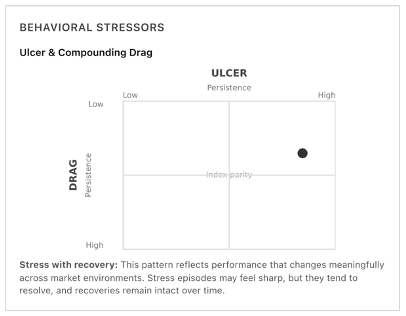

The Behavioral Stressors plot highlights the specific forms of stress an investor must be willing to endure. In the case of Berkshire Hathaway, the message is clear: patience is the defining requirement. Our analysis shows modest performance drag, paired with a persistent elevation in Ulcer Ratio relative to the broader market.

The diagnostic also identifies the Macro-Market Regimes in which the strategy is most comfortable (Green Marker) and most challenged (Red). This helps advisors assess whether to introduce stability or incremental beta, not because the strategy is “missing” anything, but because thoughtful completion can reduce behavioral strain without diluting the strategy’s intent.

Example 2: Dodge & Cox (DODGX)

Example 2: Dodge & Cox (DODGX)

Now let’s compare that with DODGX – another long-time all-star showing a slightly different profile. Again: not good/bad, but different. And the difference is exactly what advisors / investors ought to understand upfront.

In fully fragile conditions (FF), the downside picture changes more meaningfully than it did for BRKB:

FF produces more downside months than DD (18% vs 11%).

When breached, FF drawdowns are deeper on average (-9.4% vs -6.1%).

Stress is amplified in fully fragile environments, increasing behavioral strain.

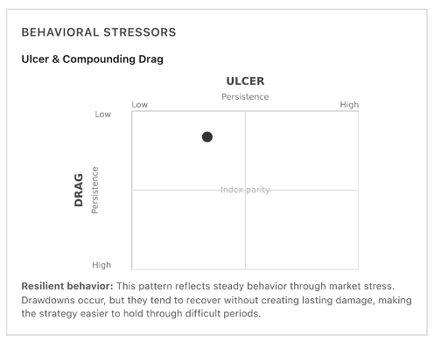

But, the story doesn’t end here, because the type of stress matters. What we see in our Behavioral Stress plot clarifies what makes DODGX a unique strategy: Resilience.

Drawdowns occur, but they tend to recover without creating lasting damage. The stress is real, but it resolves. That recovery pattern materially reduces time-under-water, making the strategy easier to hold through difficult environments.

Some strategies test investors through deeper, more visceral time-under-water. Investors may experience stress, but that stress tends to resolve and repair. Understanding these stress points in the context of their potential rewards can reduce the odds of plan abandonment.

The Unlock

Here’s the takeaway from Door #1: two hall-of-fame investments, each with a distinct macro-regime risk fingerprint. A regime-aware diagnostic sets expectations early, giving investors a realistic chance of staying invested long enough to earn what each strategy is designed to deliver.

BRKB: Stress varies modestly by environment, but the downside experience is broadly consistent — testing conviction and patience.

DODGX: Fragile environments amplify stress, yet drawdowns tend to recover without lasting damage — testing investors through events rather than endurance.

Both outperform the market over the long term. Different paths. Different behavioral requirements.

Up Next…

Regime Door One deepens our understanding of a strategy’s behavior. Regime Door Two is where regime awareness becomes portfolio architecture.

If diagnostics help set expectations by revealing where a strategy strains the investor experience and how that strain shows up, then completion becomes a design opportunity.

What happens when we introduce a completion index specifically built to relieve those stressors in the environments that tend to trigger abandonment?

That’s our next post.

About CrestCast™